2025 Innovation Grants

At a glance

Grants

Funding projects that test or scale new ways of working that improve the timeliness or efficiency of financial counselling service delivery.

- Seed Innovation Grants - testing new ideas

(up to $75,000 | up to 12 months) - Scaling-Up Innovation Grants - scaling proven ideas

(up to $225,000 | up to 24 months)

Key dates

- 11 and 13 March Webinars

- 24 March-28 April Expression of Interest open

- 12 May-9 June Full Application open

- 23 July Outcome notifications

How to apply

- Please use the EOI application link.

- Please use the same link again if you'd like to make another application.

- Please read our Grants Guidelines

- You can also sign up for updates to receive updates and deadline reminders.

- NB Please submit your form before 5pm AET on the closing date.

Webinars

Our CEO Elissa Freeman and Grants and Impact Manager Liz Gearing outlined the grant requirements and process, followed by a Q&A session, during webinars in March. You can watch the webinars below.

Our process

Innovation Grant FAQs

What is the FCIF Innovation Grant Round?

The 2025 Innovation Grant round will fund projects that test or scale new ways of working that improve the timeliness or efficiency of financial counselling service delivery.

In this context, innovation refers to new, clever ideas or changes to previous processes, programs, products or services to adapt and respond to the demand for financial counselling services. Innovation is change that adds value.

Our goal is to fund transformative initiatives that will enable financial counselling service providers to better meet the demand for their services.

What grants are available?

- Seed Innovation Grants

(up to $75,000)

Designed for organisations testing new service delivery ideas or piloting innovative approaches. These grants allow organisations to explore new models, trial digital tools, or develop new strategies before wider implementation. -

Scaling-up Innovation Grants

(up to $225,000)For organisations looking to expand or refine proven innovations. These grants support projects that have demonstrated success in a pilot phase and are ready for broader implementation, helping financial counselling services reach more people and improve efficiency on a larger scale.

Organisations can apply for a Scaling-Up Grant in connection with projects that we have not previously funded or at the completion of a project funded by a Seed Grant.

How much funding is available overall?

Up to $1.5 million will be awarded in the 2025 Innovation Grant round.

We will undertake additional Innovation Grant rounds in 2026 and 2027.

Any Grants that demonstrate high impact on completion may be encouraged to apply for further Scaling-up Innovation Grants to build on their initial success.

Up to $11.5 million in Innovation Grant funding may be awarded over 2025-2028.

How were these amounts determined?

Please see our 2025-2028 Grants Strategy page for more information.

How long is the funding period?

Seed Grants: up to 12 months.

Scaling-Up Grants: up to 2 years.

What costs will be funded?

Some examples of activities that may meet the criteria:

Seed Grants

- Test a new concept or idea that will lead to a service improvement

- Pilot a new delivery model that will increase service delivery efficiency

- Explore the use of Artificial Intelligence tools to triage case management

- Protype a new digital tool that will make it easier to deliver services

- Explore enhanced data-analysis systems that will improve service delivery

- Build an understanding of an emerging service delivery issue through applied research

Scaling-up grants

- Scale-up a new service model

- Apply a new approach to improving service efficiency

- Build and deploy a new digital tool

- Scale a proven data-sharing system

What costs will NOT be funded?

- Core operational costs

- Retrospective costs

- Projects already funded by other sources

- Academic research or degree programs

- Litigation costs

- Activities that do not support financial counselling service delivery

- Any costs that are not directly related to carrying out the activity

- Activities where the primary purpose is for profit

- Commercial or profit-making activities

- Activities not of benefit to Australian financial counselling clients

- Awareness raising activities about financial counselling

- Political activity

- Travel costs, unless they directly relate to the activity

- Funding for ongoing staff or operational costs beyond the grant term

- Expanded or additional business-as-usual direct service delivery

NEW: What core operational costs are ineligible?

Any costs incurred by your organisation in the regular course of its operations that are unrelated to the project are ineligible for funding. Project administration costs (including staffing costs) directly attributed to the project are not considered to be ineligible core operational costs.

Added 19/03/25

NEW: What staffing costs could be included in my project budget?

If you are invited to complete a full application you will be required to submit a project budget. This budget should include all project-related costs. Staffing costs that are directly attributed to the project should be included in the budget. Please note, staffing costs incurred in the regular operation of your organisation are ineligible core-operational costs.

Added 19/03/25

NEW: What academic research or degree program activities are ineligible?

We will not fund the cost of individuals to undertake degree programs, either by research or coursework.

Added 19/03/25

NEW: Is an academic researcher eligible for a grant?

No, an academic researcher will not meet our eligibility criteria to apply for a grant. However, they may choose to partner with an eligible organisation on a project. FCIF strongly encourages collaborations and partnerships.

Added 19/03/25

NEW: What awareness raising activities are ineligible?

We will not fund activities which have as their primary objective the goal of increasing demand for financial counselling services – either generally or within a specific community.

Added 19/03/25

NEW: What political activities are ineligible?

Activities that promote, support or oppose a political party, candidate or elected official are not eligible for funding.

Added 19/03/25

Is my organisation eligible for a grant?

Yes, if your organisation is:

- - an organisation currently delivering financial counselling services in Australia through financial counsellors who are members of a financial counselling peak body or financial counselling professional association; or

- - a financial counselling peak body or financial counselling professional association.

No, if you or your organisation are:

- - Individuals

- - Government entities

- - Not currently providing financial counselling services

Will you accept joint applications?

We strongly encourage collaborative applications. For example, a financial counselling service may choose to partner with a technology start up, or two services may collaborate. The lead applicant must meet the eligibility criteria.

NEW My organisation is seeking funding to provide financial counselling services. Should we seek funding in the innovation round?

No. In this round we will not fund additional direct service delivery. Opportunities to seek funding for additional direct service delivery will be available in our 2025 Expansion Grant round.

Added 01/04/2025

NEW I am not sure whether to apply for a grant in this round or a subsequent round. What should I do?

We encourage you to check whether your project/organisation meets the eligibility and assessment criteria for this grant round. If so, please apply for this round. We have yet to publish timelines and Grant Guidelines for subsequent rounds, but you will be welcome to also apply for any subsequent round when it opens (assuming you meet its criteria). Please see our 2025-2028 Strategy page for our key funding areas and anticipated timelines.

Added 01/04/2025

NEW Will organisations that have been allocated an Innovation grant also be able to apply for Expansion and Workforce grants?

Yes. Successful applicants for the Innovation grant, if eligible, can apply for the Expansion grant and Workforce grant.

NEW added 25/03/2025

NEW Would a partially funded innovation project, where additional resources are needed, be eligible?

Yes. Our intention is to avoid duplicating existing funding. Please add any existing funding partners to the Project Partners section in the EOI and outline details of the funding amount.

New added 25/03/2025

NEW My organisation has funding from the Financial Counselling Foundation. Will we be treated differently in this process?

No. Our key funding principles, as published on our 2025-2028 Strategy page, include:

FAIR PROCESSES

- Equity of access to grant opportunities

• Transparency about decision-making criteria and processes

• Robust probity measures, including managing conflicts of interest

• Using data to help inform the allocation of industry funding

In order to maintain fairness and equity, organisations currently funded by the Financial Counselling Foundation will be treated the same as any other organisation.

Added 04/01/2025

Can I email or mail my application?

No. We will only accept applications that have been submitted through our online system.

Can I apply for both a Seed and a Scaling Up Grant?

Yes. Multiple grants will be considered but must be submitted as separate applications.

What if there is a conflict of interest?

A conflict of interest declaration must be submitted with all applications.

Where a relevant conflict of interest is identified (by either an applicant or the Fund), the Fund may request the removal of a person from participating in the application, assessment and/or delivery stage of the process.

NEW: Will application questions be published in advance?

No. All questions will be available for all applicants on the opening day. This should give you sufficient time to complete your responses.

NEW 17/03/2025

Can someone from FCIF help me with my application?

FCIF staff can only provide general information and advice on completing your application. To maintain the fairness and integrity of the application process, applicants cannot be offered individual support or help with their applications. Please use the materials on this page for help in setting up an account and completing your application.

Should you experience issues logging in to Blackbaud Grantmaking, please use their login help documentation. If you are unable to resolve your issues, please contact grants@fcif.org.au.

NEW Can you give advice about whether our individual project meets the criteria for this round?

No. Probity and equity of access are critical across all our processes, as outlined on our 2025-2028 Strategy page. Our probity policies specify that all applicants must have equal access to information, so rather than answer individual queries we publish generalised answers (ie, not specific to your organisation or project) on our website, where they can be viewed by all.

Added 01/04/2025

What am I expected to provide with my application?

For the EOI we do not require any documentation.

For the Full Application, you will need to provide a budget, project plan (including milestones) and a risk assessment. Letters of support and/or previous evaluation of the proposed project can also be submitted at this stage.

All documents must be uploaded through our online system and cannot be emailed.

Should I include GST in my application?

No. If your application is successful and your organisation ABN is registered for GST, you’ll be paid GST on top of the approved grant amount. If your organisation ABN is not registered for GST or you do not have an ABN, you will only be paid the approved grant amount.

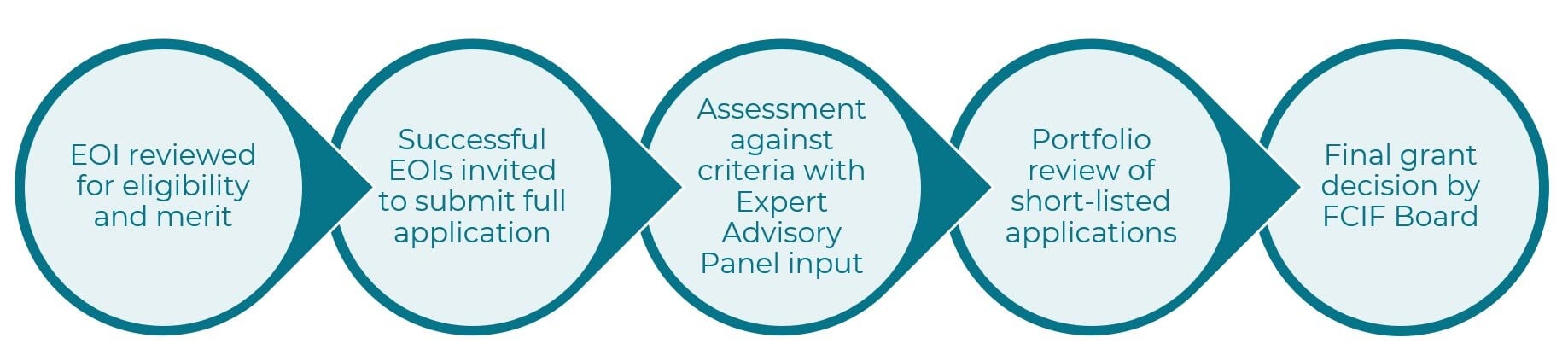

What happens once I submit my EOI?

- When you submit your EOI, you can download a copy for your records. Note that once EOIs are submitted, you cannot make any changes.

- You will receive an automated email acknowledging your EOI.

- Your EOI will then be reviewed by FCIF staff. Our team may contact you if further information is required.

- If your EOI is successful, you will be invited to complete a full application.

- Applications will be assessed by FCIF staff and Expert Advisory Panel.

- Final set of recommendations is compiled for submission to FCIF’s Board of Directors.

- Receive notification of application outcome.

What if I miss the application deadline?

Late applications will rarely be accepted unless you can make a case for exceptional circumstance. We encourage all applicants to submit your applications well before the due date to avoid last minute issues.

What happens if I made a mistake in my application?

Once your application form has been submitted it cannot be edited. However if you have made a mistake that you feel is material to your application and you would like to change your answer, please email grants@fcif.org.au and request your application be published for resubmission.

How are applications assessed?

Applications will be evaluated against the following six criteria:

- The proposed activity will improve the timeliness or efficiency of financial counselling service delivery (without adversely affecting service quality). (40%)

- The proposed activity explores a new solution or innovative idea. (25%)

- The proposed activity can deliver benefits to the wider financial counselling service delivery sector. (15%)

- The likelihood that the proposed activity will achieve its intended outcomes. (10%)

- The proposed activity can achieve a measurable impact within the grant term. (5%)

- The proposed activity has a robust data-collection plan to assess its impact. (5%)

What are my obligations if a grant is awarded?

All grants are subject to our Standard Grant Conditions, which outline obligations for grantees, such as reporting and evaluation, after a grant has been awarded.

When will I know the outcome of my EOI or application?

Successful EOI applicants will be notified by 12 May and invited to submit a full application. Outcome notifications for full applications will be completed by July 23.

Will you provide feedback?

We will endeavour to provide general feedback as to why applications are unsuccessful. However, we will not be able to provide detailed feedback regarding your application.

When is the next Innovation Grant Round?

FCIF expects to hold Innovation Rounds every year. Sign up to receive alerts when we announce dates and open grant rounds.

When will funding commence? (updated 11/03)

Funding will commence upon the final signing of your funding agreement (anticipated to be during August, subject to the timely signing of agreements).

UPDATED 11/03/2025

Do you still have questions? Email grants@fcif.org.au. We'll respond and update this page as appropriate.